are dental implants tax deductible in the united states

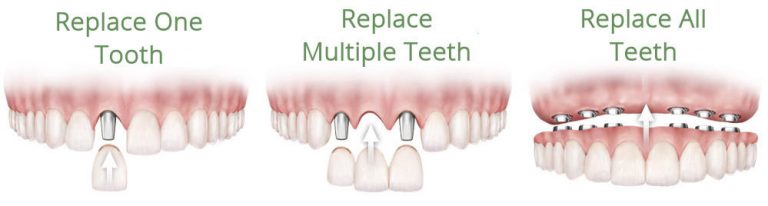

Dentures and dental implants are also tax deductible with the IRS and included in the non-preventive category but elective cosmetic procedures such as teeth whitening and veneers are not tax deductible. Generally the Internal Revenue Code allows as a deduction the expenses paid during the tax year not reimbursed by insurance for medical care of the taxpayer his or her spouse or a dependent to the extent that such expenses exceed 10 of adjusted gross income.

Are Dental Implants Tax Deductible Drake Wallace Dentistry

While not specifically non-deductable and pub 502 has a paragraph on artificial teeth stating they are deductable Iwould imagine you.

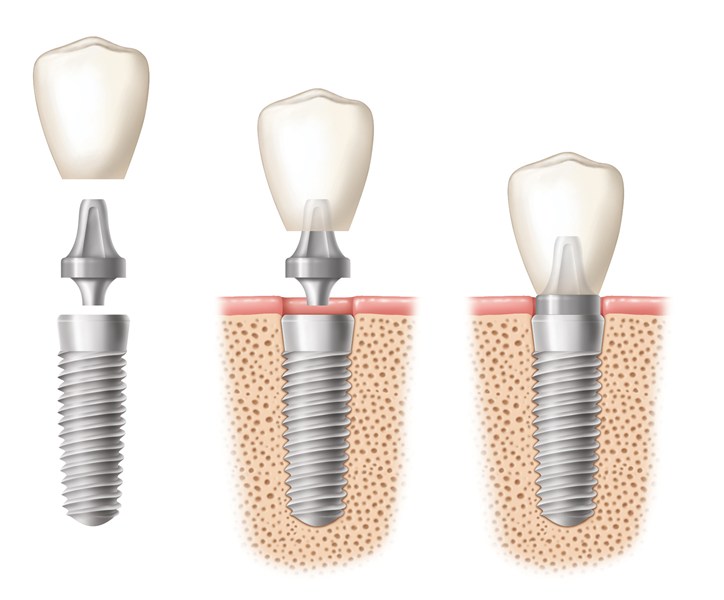

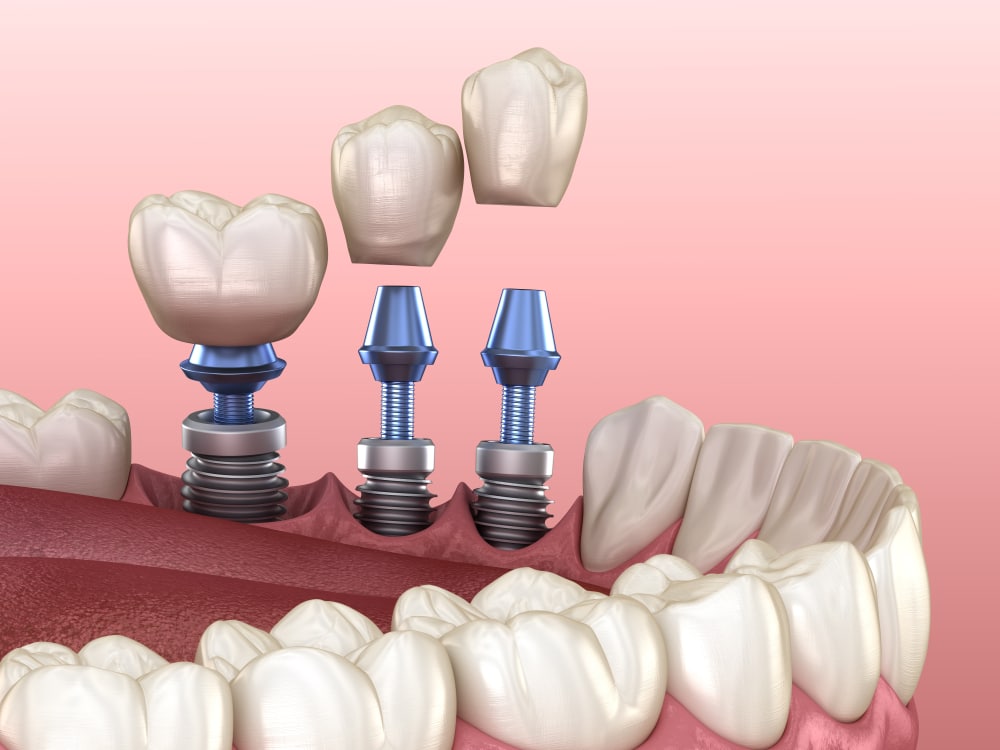

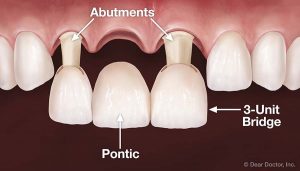

. Dental expenses are deductible along with your medical expenses on Schedule A Form 1040. Citizen or resident alien for the entire tax. The dental implant abutment is usually attached to the implant body by the abutment fixation screw and.

Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition. The refundable medical expense supplement is a refundable tax credit available to working individuals with low incomes and high medical expenses who meet the income requirement and all of the following conditions. Yes dental implants qualify as a tax-deductible medical expense under current Revenue.

Medical expenses are an itemized deduction on Schedule A and are deductible to the extent they exceed 10 of your adjusted gross income AGI. Employer-sponsored premiums paid under a premium conversion plan cafeteria plan or any other medical and dental expenses paid by the plan arent deductible unless the premiums are included in box 1 of your Form W-2 Wage and Tax Statement. By being tax-deductible it means you can get a portion of the cost back in your next tax return.

If you were reimbursed or if expenses were paid out of a Health Savings Account or an Archer Medical Savings Account. Services of a dental hygienist or dentist for teeth cleaning. For example if your insurance covers 80 of the cost of treatment for denture implants or dental implants you are responsible for paying the remaining 20.

The most common tax deductions in the United States are on charitable donations mortgage interest income tax real estate tax and dental and medical costs. Tax laws vary by country as all laws do. If any of your expenses were reimbursed by insurance your expenses must be reduced by the amount of the reimbursement.

Are Dental Implants Tax Deductible. Application of sealants and fluoride treatments to prevent tooth decay. Claiming dental expenses is an allowable deduction on your tax return.

You made a claim for medical expenses on line 33200 of your tax return or for the disability supports deduction on line 21500. Dental office deductions extended under the American Taxpayer Relief Act of 2012 Use tax benefits to reduce your office construction costs. If you hire an accountant to do your taxes just let him know about your implants and they will.

Basically If you itemize your deductions for a taxable year on. That 20 is the portion you can. If married the spouse must also have been a US.

You can deduct dental expenses for yourself your spouse or any dependents you claim on your return. The dental implant body is surgically inserted in the jawbone in place of the tooths root. While dental implants arent specifically mentioned in IRS Publication 502 the IRS says.

You can claim the portion of the procedure that you pay also known as the co-pay. If you are 65 or over they are deductible to the extent they exceed 75 Please click here for more information. Citizens or resident aliens for the entire tax year for which theyre inquiring.

Preventive treatment includes the services of a dental hygienist or dentist for such procedures as teeth cleaning the application of sealants and fluoride. Even if you have insurance coverage that includes implant treatment you could still receive a tax credit. You can use it via Schedule A to cut off your tax amount on your dental implant grants.

To get help with your dental implant cost you can use the Tax deduction as well. You can include in medical expenses the amounts you pay for the prevention and alleviation of dental disease. Remember though that your itemized deductions for medical dental expenses are reduced by 75 of your Adjusted Gross Income AGI and that total itemized deductions including whatever is left of medicaldental expenses after subtracting the 75 will save tax.

For example if youre a federal employee participating in the premium conversion plan of the Federal Employee. So you should mention what country youre in when asking this type of question In the US you can look at the IRS site linked below. Did you know your dental implants may be tax-deductible.

When use tax is a factor Use tax in the United States is complementary to sales tax which means if you buy taxable products without paying sales tax to the vendor you owe use tax. Answer 1 of 4. Yes dental implants are an approved medical expense that can be deducted on your return.

Although it does not help you to get rid of all the costs that you have to spend on the dental implant you will get some relaxation to pay off the full cost of a dental implant. What are some common tax deductions. In order to deduct the cost of the dental implant you would need to do that in Schedule A on your taxes.

The tool is designed for taxpayers who were US. For 2017 and 2018 you may deduct only the amount of your total dentalmedical expenses that exceeds 75 of your adjusted gross income. You can claim dental expenses on your taxes if you incurred fees for the prevention and alleviation of dental disease.

For future reference keep in mind that for 2019 dentalmedical expenses must exceed 10.

Dental Implant Cost In Gurgaon India 2022 Update Dantkriti Dental Clinic

How To Afford Dental Implants Without Going Broke Dental Implants Dental Implants

Dental Implant Cost Dental Implants Start From 900

Dental Implant Cost Near Me Clear Choice Cost Maryland

Does Medicare Cover Dental Implants Clearmatch Medicare

/BestDentalInsuranceforImplants-5c56e663e267499a8011f1e26d260841.jpg)

Best Dental Insurance For Implants Of 2022

Dental Implant Cost Near Me Clear Choice Cost Maryland

3 Irs Dental Implant Discount Plans Tax Deductible Savings Dental Implants Irs Taxes Tax Deductions

Dental Implant Cost Near Me Clear Choice Cost Maryland

3 Irs Dental Implant Discount Plans Tax Deductible Savings

How Much Do Dental Implants Cost In Canada Explained Groupenroll Ca

Dental Implant Cost Near Me Clear Choice Cost Maryland

12 Easy Ways To Get Affordable Dental Implants In 2022 Authority Dental

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit